Coffee with clients

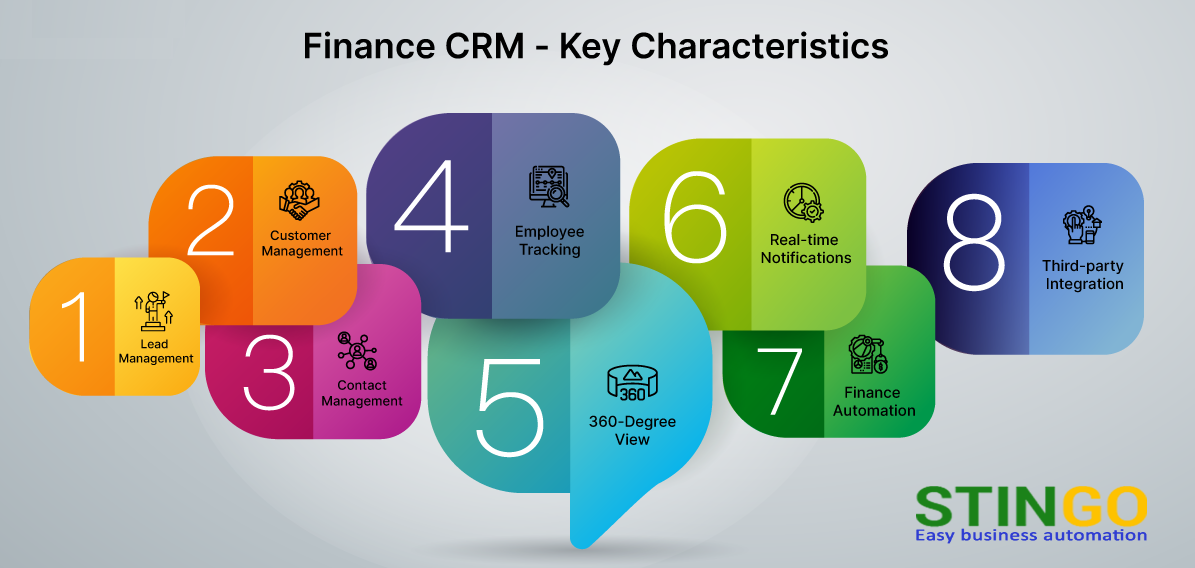

Numerous functionalities are available in the Loan DSA CRM

CRM Software loan-dsa-crm

What is Loan DSA CRM ?

Regardless of the particular lender they are dealing with, a Direct Selling Agent (DSA) may simply save and arrange all customer information in one location with the help of a Loan Customer Relationship Management (CRM) system. These consist of your contact details, the progress of your loan application at the moment, any necessary paperwork, and a history of all prior correspondence.How to handle leads

On your behalf, our lead collecting system will compile leads from various sources.One useful tool is Lead Distribution, which allows leads to be distributed to DSAs (Direct Selling Agents) according to specific criteria like area and area of expertise.

You can simply keep an eye on your leads' growth and present state in real time with lead tracking.

How to handle clients

All of the data and exchanges pertaining to a customer are kept in one single location, the customer database.A 360-Degree View provides a thorough insight of past encounters and contacts with customers.

The process of grouping clients according to specific criteria is known as segmentation. This facilitates the implementation of marketing plans that are specific to the requirements and tastes of every group.

How to handle loans

A technology called "Loan Application Processing" streamlines the manual process of examining loan applications and confirming the required paperwork.We'll keep you informed in real time about the progress of your loan application.

The job of Compliance Management is to make sure loan applications adhere to all legal and regulatory criteria.

Instruments of Communication

Email Integration: Automatic and manual email merging is a simple feature of our system.You may use our system to send automated SMS reminders and notifications because it can communicate with SMS services.

Call Management: This tool makes it simple to keep track of and record client phone calls.

Analytics and Reporting

We examine the sales funnel to find possible prospects. The system gives us data on sales performance and conversion rates.A product called consumer Insights gives companies statistics on consumer behavior that they can utilize to create strategies that work better.

Workflow and task automation

You can designate and keep track of tasks related to loan processing and lead follow-up using the task management function.Workflow Automation is a useful tool that helps you increase the efficiency of repetitive processes by automating them.

Integration Skills

A seamless link to databases and other systems is made possible by API integration.We have no trouble integrating our system with other productivity and marketing solutions from other vendors.

Ensuring that your data and systems are safe and compliant with all applicable laws and regulations is our first focus.

We have put strong safeguards in place to protect sensitive client data because we take data security extremely seriously.

One procedure that assists the business in making sure it is adhering to all legal and regulatory obligations is compliance tracking.

Mobility

Through a mobile application, users can access Customer Relationship Management (CRM).The term "responsive design" refers to a method of web design that tries to make websites that adjust to various screen sizes and devices. This implies Our website has a mobile-friendly interface and is made to be readily accessed on a variety of devices.

In terms of scalability and customisation, we have you covered.

It is possible for you to alter the interface to suit your tastes. The dashboards and processes can be altered to give them a more unique appearance.

Scalability is the system's capacity to expand along with the business, adding more features and supporting a higher user base.

There are several benefits offered by the Loan DSA CRM. The improvement in efficiency is one of the primary advantages. Our solution saves time and lowers the possibility of human error by automating lead management, loan processing, and communication.

To better comprehend and handle client interactions, we have enhanced our customer service. To satisfy their unique demands, we are able to offer timely, individualized service.

Increasing Obedience: Every loan application is checked by our system to ensure that it satisfies all applicable regulatory standards. This is significant since it reduces the possibility of any possible compliance issues.

Real-time insights are provided via the analytics and reporting tools available on our platform. These resources are intended to help you make educated decisions and modify your tactics as needed.

Stingo CRM - Loan DSA CRM - Common Questions

A piece of software called Stingo CRM assists companies in managing their client interactions. Your loan DSA business can benefit from using this software since it helps with client relationship building, interaction tracking, data management, and organization.

Direct Selling Agents (DSAs) in the loan business utilize Stingo CRM as a tool to manage client connections. It is made especially with this use in mind.

Using this technique might have a lot of advantages for your company. By using this software, lead management can be made easier, customer interactions can be improved, regulatory compliance can be guaranteed, real-time analytics can be provided, and loan processing and sales efficiency can be increased.

Could you please elaborate on how Stingo CRM manages the lead generation and distribution process?

Leads can be gathered using Stingo CRM from a variety of sources, including websites, social media, and advertising campaigns.The technology automatically distributes the leads to DSAs (Direct Sales Agents). This distribution is determined by predetermined standards including availability, competence, and location. The aim of this procedure is to guarantee the timely and efficient handling of leads.

Is Stingo CRM compatible with the platforms I already use for loan processing?

Yes, Stingo CRM is made to work in unison with the loan processing systems you already have in place.Because the system can interact with APIs, it can readily exchange data with other systems. This guarantees an error-free and seamless loan application process.

Stingo CRM has put in place a number of security measures to guarantee the protection of customer data. These safeguards have been put in place to ensure that client information is secure and confidential.

We at Stingo CRM have implemented several safeguards to guarantee the protection of your information. We protect your data using a variety of protections as part of our security measures. These include of encrypting the data, putting safe access controls in place, carrying out frequent security audits, and making sure data protection laws are followed.

These safeguards have been put in place by our organization to protect sensitive and confidential client data. This feature aids in preventing any illegal access or breaches that can jeopardize the data's security.

Is it feasible to alter Stingo CRM to satisfy the unique needs of my DSA operations?

Yes, there is a lot of customization available with Stingo CRM. The interface, dashboards, processes, and reporting tools may all be customized to fit the unique requirements and preferences of your DSA operations.Because of its adaptability, the CRM may be tailored to meet the unique objectives and business procedures of your organization.